CACFP Operators and the Limited PSLF Waiver

September 8, 2022

The Public Service Loan Forgiveness (PSLF) program was created in 2007 and allows government and nonprofit employees to be forgiven for Direct Loan Program loans after ten years of service. It was meant to be a straightforward incentive for federal student loan holders to work in teaching, policing, nonprofit or government jobs. However, until recently, 99% of PSLF applications were rejected.

Thankfully, the White House has taken steps to streamline the PSLF application process and improve the applicant success rate. In fact, in August, the White House issued a limited waiver allowing ineligible payments to count toward consideration for those who apply by October 31, 2022. Under the temporary changes, you can get credit for past payments, even if you:

- had or have a Federal Family Education Program (FFEL) loan or Perkins loan (you must consolidate into a Direct Loan Program prior to October 31, 2022),

- didn’t make the payment on time,

- didn’t pay the full amount due, or

- weren’t on the right repayment plan.

Read the Limited PSLF Waiver Explainer Document for more information.

Who Qualifies for PSLF?

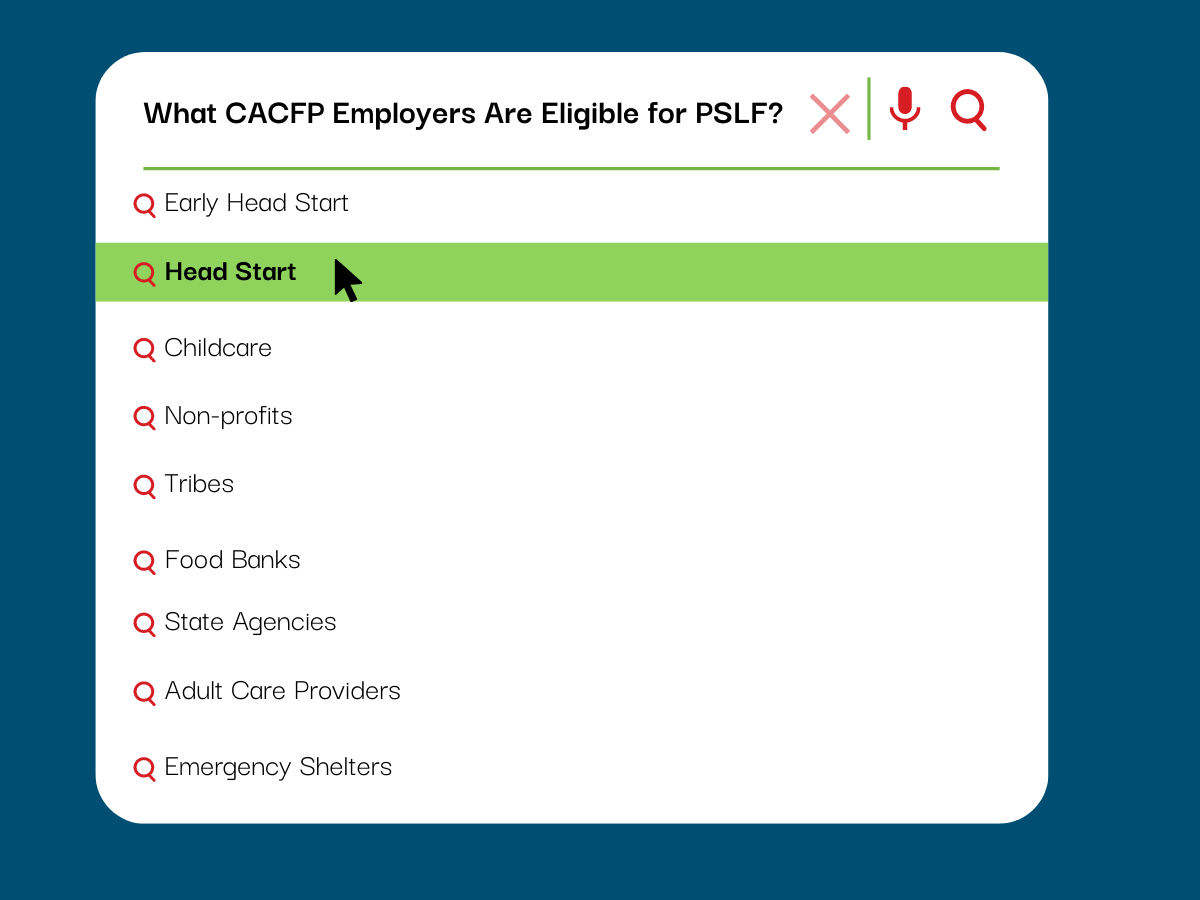

In short, government and nonprofit employees who have worked for at least ten years for a qualifying employer while making payments toward their federal student loans are eligible for PSLF. Here are some examples of qualifying employers and organizations:

- Any U.S. federal, state, local, or tribal government agency, or the Peace Corps or Americorps

- Emergency management

- Military service: service on behalf of the U.S. armed forces or the National Guard

- Public safety

- Law enforcement: crime prevention, control or reduction of crime, or the enforcement of criminal law

- Public interest law services: legal services provided by an organization that is funded in whole or in part by a U.S. federal, state, local, or tribal government

- Early childhood education: includes licensed or regulated child care, Head Start, and state-funded prekindergarten

- Public service for individuals with disabilities and the elderly

- Public health

- Public education

- Public library services

- School library services

- Other school-based services

If you think you may qualify and you have a W2 or your employer’s Employee Identification Number (EIN) handy, check out the Public Service Loan Forgiveness Employer Search to verify that your employer qualifies under the program.

Help Get the Word Out

Fortunately, many who work for sponsoring agencies, state agencies or organizations who directly operate the CACFP are eligible for PSLF. Economic challenges following the pandemic have been particularly unkind to childcare workers and educators, and the PSLF represents a fantastic opportunity for many within the CACFP community to gain much-needed financial assistance.

While the program itself doesn’t have an expiration date, the special limited waiver period that allows some would-be ineligible payments to be included in applications ends on October 31, 2022. Workplace leaders can promote timely participation in this program by sharing the following:

- PSLF One-Pager for Early Childhood Educators

- Watch the recording of this September 12th Webinar from the Office of Head Start on the Limited PSLF Waiver and early childhood educators

- Save and Share the Limited PSLF Waiver Social Media Kit

- Sign up to participate in a PSLF Day of Action

The Nitty-Gritty: FAQs on PSLF

Here are a few key FAQs on PSLF for early childhood educators and others who are part of the CACFP community. Visit the PSLF page at studentaid.gov for a complete list of FAQs.

What determines whether I am considered to be an employee of a qualifying employer?

If a qualifying employer hired you, pays you and sends you a Form W-2 (Wage and Tax Statement) at the end of each tax year, you are employed by the qualifying employer.

On the other hand, if you were hired by a government contractor and the contractor issues your Form W-2, you are employed by the contractor. In this case, although you may be doing work for a qualifying employer (a government agency), you are not an employee of the qualifying employer.

What types of public service jobs will qualify me for loan forgiveness under the PSLF Program?

The specific job that you perform doesn’t matter, as long as you’re employed by a qualifying employer. For example, if you’re a full-time employee of a public school system, your employment would meet the requirements for PSLF, regardless of your position (teacher, administrator, support staff, etc.).

Can I receive PSLF if I have more than one employer over the course of 10 years?

Yes. However, you must submit a PSLF Form showing that you were employed full-time by a qualifying employer at the time you made each of the required 120 payments.

What if I make my last qualifying payment while working for a qualifying employer, but then leave that job to work for a for-profit corporation before applying for the PSLF benefit. Am I still eligible for PSLF?

No. To be eligible for forgiveness after making 120 qualifying payments, you must be employed full-time by a qualifying employer at the time you make each qualifying payment, at the time you apply for loan forgiveness, and at the time you receive loan forgiveness. Therefore, if you leave your job at a qualifying employer after meeting the PSLF eligibility requirements but before you apply for loan forgiveness, you will not be eligible for forgiveness since you must be working for a qualifying employer at the time you apply for and receive forgiveness. However, you could regain eligibility if you later find full-time employment at another qualifying employer and then apply for loan forgiveness.